Falling Wedge Chart Patterns Education

Content

Some even believe that the wedge patterns spotted in longer time frames are more potent as it takes more effort to form them. Charts are crucial in crypto trading as it contains lots of valuable information about the market. We’ve also learned that understanding chart patterns is essential for traders to decide the best action they need to take in response to the market situation. Target – There is no specific target in this pattern, most traders enjoy the profit by applying trailing stoploss. The limitation for the target will be last three resistance level which was formed before by the price action. In a rising wedge, both boundary lines slant up from left to right.

As one can see, February 26, 2019, has been the beginning of the uptrend for the next few days. Falling wedges are some of the most popular trading pattern around, and when used in the right manner, they can pinpoint great trading opportunities in the markets. As you might have expected, the rising wedge is very similar to the falling wedge.

Traders can look to the starting point of the descending wedge pattern and measure the vertical distance between support and resistance. Then, superimpose that same distance ahead of the current price but only once there has been a breakout. The falling wedge pattern is interpreted as both a bullish continuation and bullish reversal pattern which gives rise to some confusion in the identification of the pattern. Both scenarios contain different market conditions which must be taken into consideration. The second phase is when the consolidation phase starts, which takes the price action lower.

- A falling wedge is a chart pattern formed by drawing two descending trend lines, one representing highs and one representing lows.

- This pattern can be best employed to ascertain the spot reversals that are present in the market.

- This article provides a technical approach to trading the falling wedge, using forex and gold examples, and highlights key points to keep in mind when trading this pattern.

- Join thousands of traders who choose a mobile-first broker for trading the markets.

- The first strategy suggests taking a long position when the price breaks the top side of the wedge.

- The triangle which will form later will be smaller than the former.

Most trading patterns and formations cannot be used on their own, since they simply aren’t profitable enough. Still, they can provide a great foundation, on which you may add various filters and conditions to improve the accuracy of the signal provided. In other words, you try to rule out those patterns that don’t work so well. As such, buying pressure increases even more, which helps to ensure the continuation of that positive price swing.

It exists when the price is making lower highs and lower lows which form two contracting lines. The falling wedge usually precedes a reversal to the upside. This means that traders can look for potential buying opportunities.

Trade binary options with a Wedge pattern

As with most patterns, it is important to wait for a breakout and combine other aspects of technical analysis to confirm signals. Falling Wedge Pattern is one of the tools used by traders who use technical analysis of stocks to take positions in equity and currency markets. A falling wedge pattern signals a bullish reversal in prices of the securities. It is also termed as the descending wedge pattern by traders.

The trend lines drawn above and below the price chart pattern can converge to help a trader or analyst anticipate a breakout reversal. While price can be out of either trend line, wedge patterns have a tendency to break in the opposite direction from the trend lines. This pattern can be best employed to ascertain the spot reversals that are present in the market.

Traders can look to the volume indicator to see higher volume in the move up. Additionally, divergence can be observed as the market is making lower lows but the stochastic indicator is making higher lows – this indicates a potential reversal. Moving average convergence/divergence is a momentum indicator that shows the relationship between two moving averages of a security’s price. A flat bottom with lower highs or a declining trendline, while the falling wedge doesn’t have a flat bottom.

As we mentioned earlier, false breakouts is one of the biggest challenges breakout traders face. One common techniques that attempts to make them fewer, is to add some distance to the breakout level itself. This ensures that the breakout level is hit fewer times by accident, which in theory makes those few times it’s actually crosses more reliable. By watching the size and direction of the gaps in the market, we may get a better sense of the prevailing market sentiment. However, before we do so, we want to make sure that you always remember that no pattern, regardless of its hypothetical performance, is going to work on all timeframes and markets.

When the price action breaks the pivot high near the apex point, the closing of the breakout candle will be the entry point. The price can come back for a re-test till the support level and bounces back that will be another entry point for you. It indicates the reversal of the downward trend into bull run or the continuation of the current trend. It is not easy to identify, all it takes is few trend lines and consistent study of the charts to make the right opportunity for yourself to earn good profits. The Falling wedge Pattern is a powerful bullish pattern which occurs in technical chart.

LINK MVRV Chart

The simplest way to do this is to wait for the next candlestick after the breakout. If it is green, then bullish momentum may have taken hold; if it is red then it may be best to wait. The price of LINK, Chainlink’s native currency, came short of brushing shoulders with $16 following the latest upswing from the support approximately at $12.5. In the article, I used images taken from the Olymp Trade trading platform. This is a platform supporting 2 types of trading including Forex and binary options .

It all depends on the timeframe and market you trade, and how it resonates with the pattern. In the image below you see how we have added some distance to the breakout level. Many times they’re combined with stop losses, which means that you have an exit mechanism that will get you out at a loss or a profit. Having said that, here is what a falling wedge might tell us about how market players act at the moment. Traders use this to identify the reversal of the downtrend or continuation of the current trend. Stoploss – You can add the stoploss at the opening of the breakout candle.

Overall guidelines to identify the pattern

Wedge chart pattern in forex refers to a reversal chart pattern that consists of two trend lines and indicates a decrease in momentum of price trend with the time. Price structure resembles a rising or falling wedge pattern. Like first swing will be the biggest one and then next will be smaller and so on until a trend line breakout will happen against the trend. The falling wedge pattern is characterized https://xcritical.com/ by a chart pattern which forms when the market makes lower lows and lower highs with a contracting range. When this pattern is found in a downward trend, it is considered a reversal pattern, as the contraction of the range indicates the downtrend is losing steam. The descending wedge pattern aligns with an uptrend when there is a consolidation in prices, or the trade is more sideways.

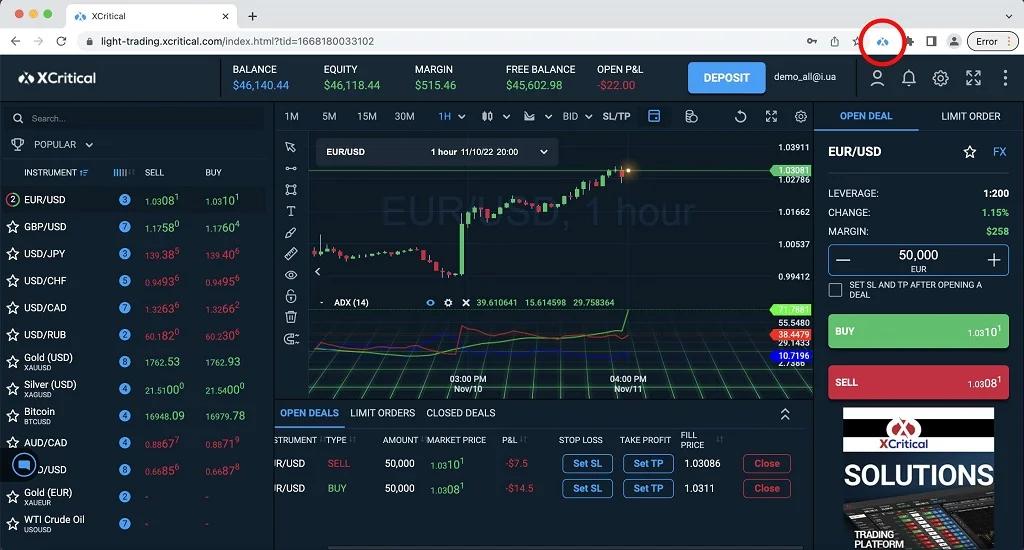

In this technical chart, it is clearly visible how a falling wedge pattern is being formed by the price movement of the currency pair. The falling wedge is a bullish price pattern that forms in a positive trend, marking a short pause that’s expected to result in a breakout to the upside. Still, some traders choose to regard the pattern as a bearish sign. For binary options trading, the perfect entry point using this pattern is the retest point of the price after a breakout. You can use a 5-minute or 10-minute Japanese candlestick chart to search for wedge patterns. This is a narrowing price channel with the two support and resistance levels pointing down.

A falling wedge pattern indicates a continuation or a reversal depending on the current trend. In terms of its appearance, the pattern is widest at the top and becomes narrower as it moves downward. It is a bullish pattern that starts wide at the top and contracts as prices move lower. This price action forms a cone that slopes down as the reaction highs and reaction lows converge. In contrast to symmetrical triangles, which have no definitive slope and no bias, falling wedges slope down and have a bullish bias. However, this bullish bias cannot be realized until a resistance breakout occurs.

quiz: Understanding Cup and handle pattern

In some cases, traders should wait for a break above the previous high. Here, a common strategy for placing your stop loss is to put it just below the market’s previous high – the last time it tested resistance. Then, if the pattern fails, your position is closed automatically. The height of what does a falling wedge indicate the wedge can be used to calculate a profit target. You’d want to see falling volume within the pattern, the same as within a descending wedge. The lower volume signals that the upward price action seen within the pattern doesn’t have much momentum behind it, making a reversal more likely.

Putting the breakout aside, the 50-day Simple Moving Average was LINK’s immediate support. If it stays in place, LINK may soon resume the uptrend above $16 and make way towards the target at $22.5. In light of the bullish sentiments, more resistance would be projected at the 100-day SMA, currently holding at $18, $20, and the 200-day SMA. There are two cases where you can open a DOWN order with a rising wedge. The first one is when it comes after an uptrend and the price breaks out and then goes down. The pattern often appears in a downtrend as a form of accumulation.

Start wedge pattern trading

The first trend line will meet the higher lows of swings in upward direction. Then the second line will meet the higher highs of swings in upward direction. Therefore, it is imperative to stick to the predefined stop loss in any trade. Generally, in case of a falling wedge pattern, the breakout is in an upward direction.

Rising Wedge patterns

We don’t just give traders a chance to earn, but we also teach them how. They develop original trading strategies and teach traders how to use them intelligently in open webinars, and they consult one-on-one with traders. Education is conducted in all the languages that our traders speak.

It is generally considered a bearish signal, meaning the price is predicted to move downward. The Falling Wedge is a technical chart pattern used to identify the opportunity to earn profits in stock market. The Falling wedge also indicates the continuation of the current trend. As the pattern continues to develop, the resistance and support should appear to converge. The change in lows indicates a fall in selling pressure, and it creates a support line with a smaller slope than the resistance line. The pattern is confirmed when the resistance is broken convincingly.

Entry

When the wedge starts to form you should be able to draw a line that connects the local highs, and another one that connects the local lows. Both these lines should be sloping downwards, and converge. This means that the distance the market can move gets smaller and smaller the further it moves into the wedge. The broadening wedge pattern is a type of wedge that looks a bit different to the ascending and descending variants. Instead of pointing towards each other, the support and resistance lines diverge – hence the ‘broadening’ in the name. In a falling wedge, both boundary lines slant down from left to right.

Leave a Reply